Flat Money is Entering Phase 2: Fueling Adoption for Decentralized Onchain Money on Base

Flat Money, the decentralized delta-neutral flatcoin protocol on Base, is lifting its deposit caps for a full launch. Explore how this move promotes decentralized onchain money, enhances security, and fosters the flatcoin asset class.

The decentralized delta-neutral flatcoin protocol on Base is approaching a full uncapped launch this June.

With Flat Money, we’ve built a protocol you can use to store and grow value while you untether yourself from TradFi risks onchain. We’re excited to lift the deposit caps and open up Flat Money to users who are passionate about onchain money rooted in cypherpunk ideals.

Building Decentralized Onchain Money, Popularizing the Flatcoin Asset Class

Decentralized finance (DeFi) emerged from the cypherpunk movement, which promotes a more open internet where applications are censorship-resistant, open source, fully auditable and as free from centralization as possible.

Over the last several years, more and more protocols have sacrificed true decentralization for greater scalability. While early Ethereum builders envisioned an alternative financial system where everyone was free to transact, many in DeFi have integrated tokenized TradFi assets into their protocols. In 2024, centralization is pervasive onchain. Just look at the stablecoin sector.

Stablecoins remain the most popular onchain store of value: 96.55% of the total stablecoin marketcap is represented by centralized stablecoins. Whether we like it or not, DeFi is closely connected to the legacy financial system. If we want to untether ourselves and return to our cypherpunk ideals, we need a renaissance for decentralized onchain money. Flatcoins–ungovernable, uncensorable, decentralized money–have an important role to play in this new era as we return to cypherpunk roots.

Flat Money is our contribution to this movement. We created this protocol for everyone and anyone who wants to preserve their purchasing power, offset volatility within crypto markets, and further adoption for unstoppable onchain money.

As we transition from Phase 1, an early beta release of the Flat Money protocol, into Phase 2, we want to take the time to review Flat Money’s progress and dive into the details of the full launch.

Phase 1 Recap

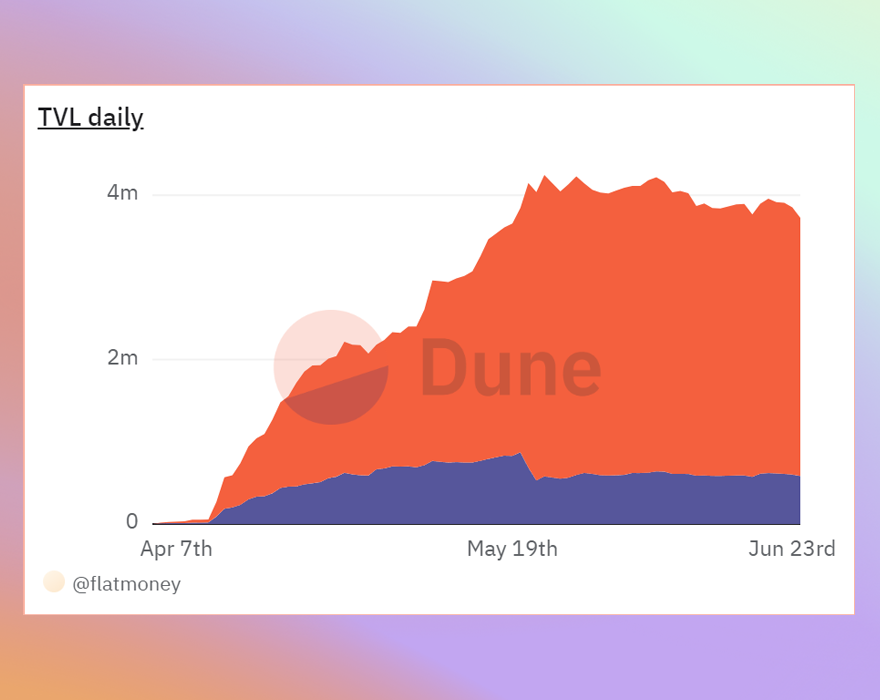

Flat Money officially entered Phase 1 in mid-April. Since then $3.12M has been deposited in the Flat Money Market and $579K has been deposited as margin collateral in the Perpetual Futures Market. In total, Flat Money’s TVL has grown to more than $3.7M in the last month, which represents $462k in weekly growth.

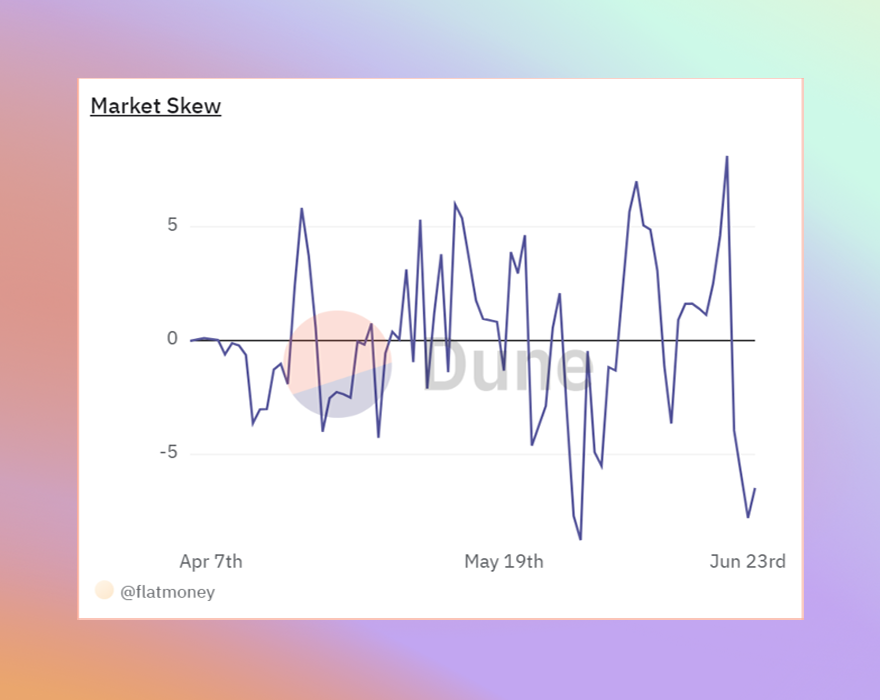

During Phase 1, the Flat Money and Perpetual Futures Markets remained in balance as the Borrow Rate (a.k.a., funding rate) created the necessary incentives to maintain a delta-neutral equilibrium between the two markets.

The difference between long positions and positions in the Flat Money Market, known as the skew, has remained balanced since the initial deployment of the protocol.

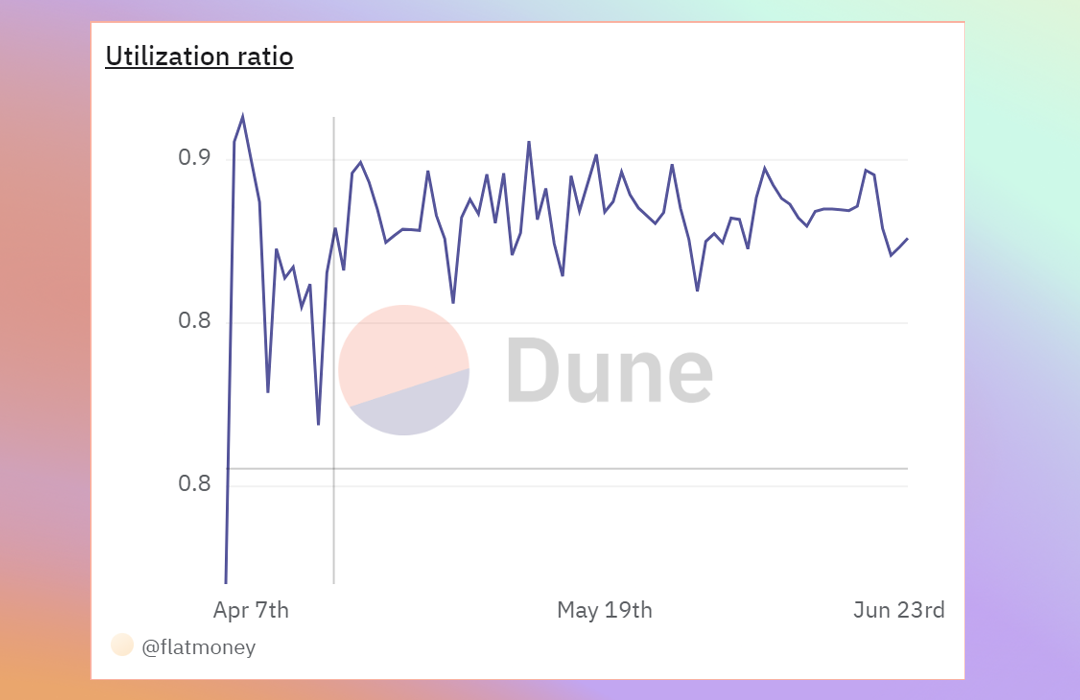

In April, funding rates across perpetual onchain and offchain markets were in the single digits, which resulted in slower growth within the Perpetual Futures Market. However, Leverage Traders have maintained a utilization ratio of 80% or greater on average since launch. Now that rates have improved, Flat Money’s Borrow Rate has caught the interest of more Leverage Traders on Base.

Flat Money’s steady growth highlights the desire for decentralized money on Base. We’ve worked to educate users about flatcoins and our overall mission through our Building Better Money blog series.

Phase 2 will provide us with more opportunities to share our message and mission with onchain users.

Entering Phase 2

We’re lifting the caps on the Flat Money and Perpetual Futures Markets! The protocol has been live for seven weeks and everything is working as intended. We no longer need the caps—Flat Money is now open to everyone.

Added Security, Bug Bounty Coverage Program with Sherlock

We’ve worked diligently over the last six months to secure Flat Money’s codebase. The Flat Money team’s security practices include fuzzing, unit testing, and routine peer reviews of the codebase.

In addition to in-house testing, we’ve worked with Sherlock to audit the Flat Money codebase. Sherlock is an incentive-aligned auditing protocol that provides a hybrid audit, which combines the benefits of a legacy audit and an audit competition.

Sherlock’s Watsons were able to find three medium severity issues in the April audit, all of which were resolved and updated in our codebase. To review the Sherlock audit reports, see the Protocol Security section in the Flat Money documentation.

As an added security measure, we’ve also purchased $50,000 of Bug Bounty Coverage from Sherlock, which will cover the cost of critical severity disclosures through our Immunefi bug bounty program. While audits play a crucial role in security, we want to provide skilled whitehats with ample incentives to review our codebase in perpetuity. Thanks to Sherlock, we can offer a sizeable reward for eagle-eyed whitehats. As Flat Money grows, we can increase our coverage with Sherlock to boost these incentives for whitehats.

To learn more about Flat Money’s security practices in detail and the risks of using Flat Money, see our documentation.

Making Decentralized Money Widely Accessible on Base

To create an open, inclusive financial system, users like you need to transact at a low cost. Historically, gas costs on Ethereum have prevented users from transacting onchain. We want to ensure that Flat Money is available to the greatest number of users, which is why we needed to deploy on an L2 that prioritizes both adoption and Ethereum’s core values.

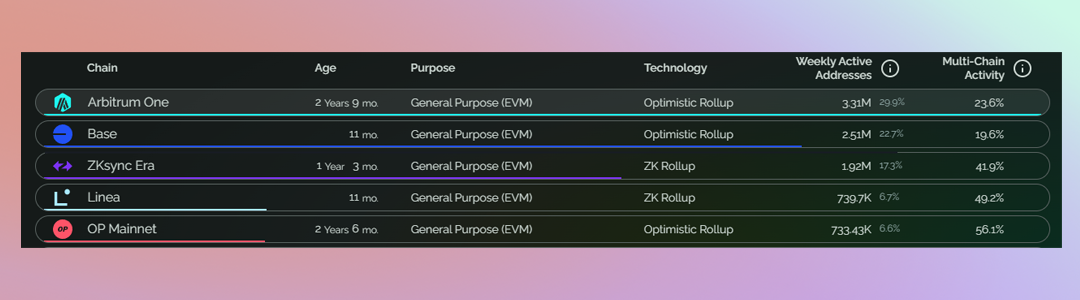

That’s precisely why we’ve built Flat Money on Base, an Ethereum Layer 2 optimistic rollup with low transaction fees. It’s ideal for participants in both markets within the Flat Money protocol. Over the last 10 months, Base has cultivated a community with more than 2.51M weekly active addresses.

We’re proud to take part in the decentralized onchain money renaissance on Base. As the Base ecosystem continues to grow, we’ll continue our mission to bring decentralized money to the masses.

It’s time for Based Money to have its moment.

To learn more about the Flat Money protocol: