The Case for UNIT: Building Better Onchain Money on Base

An overview of the fundamentals behind UNIT, Flat Money’s decentralized delta-neutral flatcoin backed by Rocket Pool ETH (rETH) and built on Base.

In the first installment of our Building Better Money series, we talked about the crucial need for native onchain money and the Flat Money philosophy behind building decentralized money backed by ETH liquid staking derivatives (LSDs) and pure ETH, which we refer to as The ETH Standard.

In this post, we’ll talk about UNIT—the first decentralized delta-neutral flatcoin backed by Rocket Pool ETH (rETH) and built on Base—and how The ETH Standard is at the heart of the Flat Money protocol.

From Cybercash to Native Onchain Money

Since the internet entered the collective consciousness in the ‘90s, people have dreamed of a new form of money enabled by the internet that wasn’t beholden to any one nation or any nation’s monetary policy. In 1997, Davidson and Rees-Mogg published The Sovereign Individual, which predicted the rise of “cybercash,” a digital currency that would be private, secure and decentralized, and the “denationalization of money,” a future where the separation between money and state would be possible.

This bold vision served as the catalyst that led to the creation of numerous internet companies–most notably PayPal–that started out with the mission to bring “cybercash” to life through the internet. None of these companies would see this mission through. And then in 2009, Bitcoin emerged with the first unstoppable decentralized ledger where people could store value and transact free from any government or nation-state.

Since the Bitcoin network was established, many blockchain ledgers have launched but none have been as successful as the Ethereum network, which introduced the programmable application layer. While the Ethereum network has become the center of the decentralized finance (DeFi) movement, attempts to create “cybercash” have fallen short. Instead, we’ve seen stablecoins (i.e., tokenized USD) emerge and dominate, with the stablecoin market capitalization growing to over $148B.

While many have forgotten about the excitement and early promise of creating ungovernable, uncensorable internet money, the Flat Money team has not. We recognize the dire need for decentralized, censorship-resistant onchain money that can be used to store value, transact, and escape the devaluation many onchain cash-equivalents suffer from.

That’s why we’ve been building a better form of onchain money that’s inspired by the same motivations and ideals behind “cybercash.”

Introducing DeFi’s Based UNIT of Currency

With Flat Money, we’ve built a protocol where people can create onchain money that’s uncensorable, inflation resistant, and backed by decentralized collateral. We firmly believe people need a decentralized alternative to centralized stablecoins, which continue to expose our onchain economy to offchain legacy financial risks.

Through the Flat Money protocol, people can mint UNIT, the first decentralized delta-neutral flatcoin backed by Rocket Pool ETH (rETH) and built on Base.

We know people want onchain money that can act as a store of value and as a hedge against inflation. Anyone can store and grow value just by holding the UNIT flatcoin—an ungovernable, uncensorable form of money on Base.

UNIT Fundamentals

After the Flat Money protocol launches, people will be able to deposit rETH into the Flat Money Market and mint UNIT.

By minting and holding UNIT, people can preserve their purchasing power and offset volatility within crypto markets. While ETH is still very volatile, UNIT is able to dampen the underlying rETH volatility and achieve relative stability. Over time, the intrinsic yield generated within the Flat Money protocol will increase UNIT’s value.

A Floating Peg Starting at the rETH-Backing Value

When it comes to a unit of account, most DeFi users are still looking at their portfolio in USD terms instead of ETH terms. If you believe in the future of ETH and the Ethereum network, holding UNIT allows you to hedge against ETH’s volatility and accrue steady value in USD terms without losing value over time to inflation.

Instead of holding a stablecoin pegged to 1 USD that’s devalued by inflation and backed by centralized collateral, you can hold UNIT. UNIT provides holders with intrinsic yield and is fully backed by decentralized collateral.

While UNIT won’t be pegged to 1 USD, it is designed to hold and grow its value in fiat terms over time. At launch, UNIT’s value will begin at a value of 1 rETH.

We chose rETH as the first ETH LSD collateral backing for UNIT because the Rocket Pool community is unwavering in their commitment to decentralization. With rETH as collateral, UNIT becomes censorship-resistant and unstoppable. Over time, we plan to add other decentralization-focused ETH LSDs to UNIT’s backing.

UNIT’s Intrinsic Yield

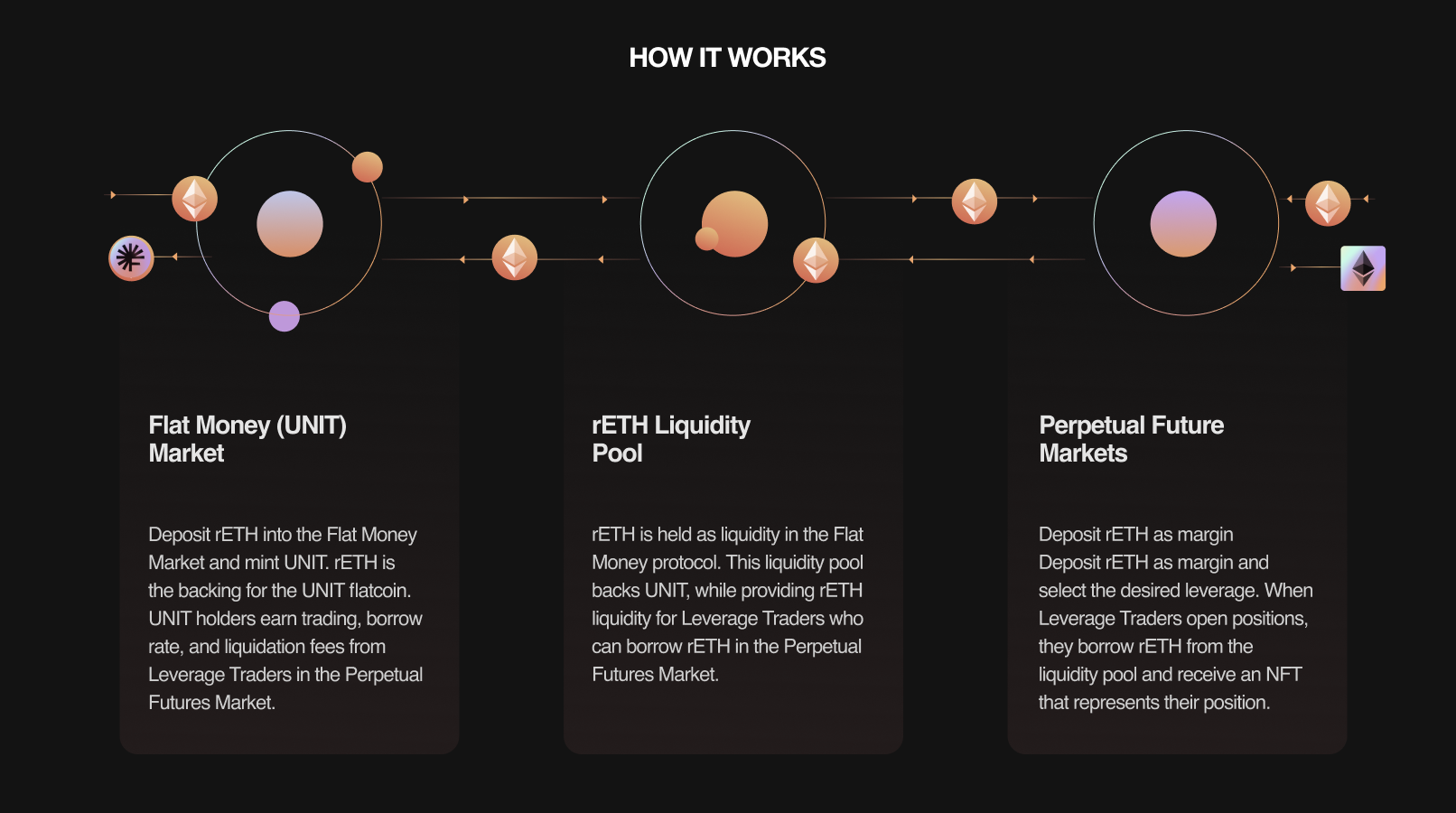

The Flat Money protocol has a dual-market infrastructure, which allows people to participate in the Flat Money Market as UNIT holders or in the Perpetual Futures Market as Leverage Traders.

The rETH backing UNIT is held within the protocol’s rETH liquidity pool. Leverage Traders participating in the Perpetual Futures Market can deposit margin collateral to borrow rETH from the liquidity pool and open rETH leverage positions. Users with open leverage positions pay trading and funding rate fees (when the rate is positive) that flow into the liquidity pool backing the UNIT flatcoin. When Leverage Traders are liquidated, liquidation fees flow into this liquidity pool.

In total, UNIT holders earn trading, funding rate, and liquidation fees in addition to the native rETH staking yield. This dual-market approach balances incentives between both markets to achieve a delta-neutral equilibrium, while providing UNIT holders with intrinsic yield generated by the protocol.

- When demand for rETH is high in the Perpetual Futures Market, the APY in the Flat Money Market will grow until sufficient rETH is deposited and more UNIT is minted.

- When demand for rETH is low in the Perpetual Futures Market, the funding rate will lower until it reaches a competitive rate that attracts more Leverage Traders to the Perpetual Futures Market, where they have an incentive to open new rETH leverage positions.

Building a native perpetual futures market into the Flat Money protocol allows UNIT holders to earn trading and liquidation fees in addition to funding rate fees and ETH staking yields. This approach sets Flat Money apart from the majority of current delta-neutral strategies in DeFi, which rely on existing onchain or centralized exchange markets. These strategies only earn funding rate fees and ETH staking yields when staked ETH is used as collateral.

Making UNIT Widely Accessible

Transacting on Ethereum mainnet can be cost-prohibitive due to high gas costs. As more transactions are settled on Ethereum mainnet, this problem will persist.

For decentralized onchain money to have the greatest impact, it needs to be available to everyone regardless of their economic status. Whether you have 0.00025 rETH or 5000 rETH, you should be able to mint and hold UNIT.

That’s why we’ve built Flat Money on Base, an Ethereum Layer 2 rollup with extremely low transaction fees. It’s ideal for participants in both markets within the Flat Money protocol.

As the Base ecosystem grows, Flat Money can provide Base users with the Flat-Pill choice to choose decentralized onchain money to store and grow value; in the near future, we envision UNIT being used as collateral throughout the Base ecosystem.

Bringing Better Onchain Money to Base

At Flat Money, we’re on a mission to bring decentralized onchain money to the masses, which is why the Flat Money movement is starting on Base, where the next million onchain users will store value, transact, and earn in DeFi.

At launch, the Flat Money Market will have an initial $2.5M of rETH deposited to mint UNIT thanks to the UNIT OGs who contributed capital to the Early Depositor Vault. This initial rETH liquidity will provide potential Leverage Traders with liquidity to open rETH long positions in the Perpetual Futures Market.

In the upcoming third installment of our Building Better Money series, we’ll talk about bootstrapping the Perpetual Futures Market within the Flat Money protocol and how Flat Money can benefit other onchain perpetual markets on Base when we launch later this month.